An important concept in technical analysis is the determination of the trend of the market.

This is a classical technical analysis with a detailed study of trend lines. Trend lines in addition to help indentifying the prevailing trend and also clearly shows the support and resistance level of the price.

As a trader or an investor I personally feel by drawing trend lines one can easily identify key support and resistance levels for effective and successful trading indentifying support and resistance levels are important.

Support: A support level is a price level that has strong buying strength that can absorb all selling strength.

Resistance: A resistance level is a price level where sellers have upper hand they prevent further increase in price.

Now I will move to

- construction of trend lines (how to draw trend lines)

- use of trendlines in support and resistance and

- Extending a trend lines.

Trend lines are straight lines drawn by connecting two or more price points and extending the line to show its support /resistance of the price movement in either an up trending or down trending market.

To draw a trendlines in an up trending market,

- Identify two nearby lows where the second low is higher than the first low

- Connect these two lows by drawing a straight line and extend it to the top

- Identify two tops (high) where the second high is lower than the first top

- Connect these two tops by drawing a straight line.

Use of trendlines in support and resistance analysis

Now we know how to draw trendlines, we will now see why they are so important in technical analysis.

Trendlines not only show the direction of the trend but also show the levels of support and resistance.

An uptrend line that is drawn by connecting the lows (as supports) of the price movement, we expect the price to be moving above the trendline. On the other hand , a downtrend line that is drawn by connecting the top(high) provides resistance to the upward movement of the price, here we expect price to move below the downtrend line.

Important: Any breaking of either the uptrend and downtrend lines indicates a possible change in trend, it’s a very good warning for the trader to adjust their position accordingly.

Strategy: A simple strategy can be devised by,

- Buy near the uptrend lines

- Sell or short near the downtrend lines

Note: While the above strategies are simple, but their effectiveness depends on identifying strong and dominant trendlines. We can also draw multiple trendlines

A simple thumb rule to identify the most important ones is the lines that have the most contact points (lines touching most number of lows or highs) and extend over a longer timeframe. Those important trendlines provide very good indication whether a trade has a good risk-reward ratio.

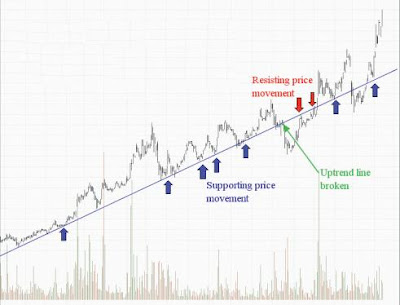

Below chart shows how trendlines provide support and resistance to the price movement. Notice how the breaking of the important trendlines indicates a turnaround in the market sentiment.

Extending trendlines

When trendlines are broken, such lines should not be discarded as they retain much importance in future price movement. Extending a broken trendline to determine future levels of support and resistance is termed extended trendlines.

Below chart shows such an example of extended trendlines.

With the extended trendline briefly resisting upward price movement (shown by the red arrows). When the prices again went above the extended trendline, the line is once more providing support to the price movement.

This chart illustrates why it is important to extend a major trendline with the line initially providing support to the price movement, then resistance and then support again.

The use of trendline is a very important component to build a successful trading strategy. While some traders use trendlines alone to trade the market, it is advisable to combine the use of trendline with other facets of technical analysis such as price and volume indicators to determine the price momentum and money flow when prices are near the trendlines or when a trendline break occurs.

No comments:

Post a Comment